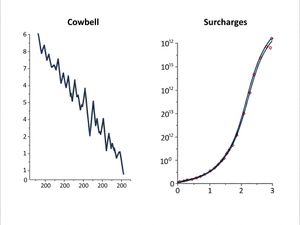

Forget the Cowbell, More Surcharges

Say it ain’t so! The era of parcel discounts may be coming to an end.

It’s a far cry from UPS CEO Carol Tomé’s August 2024 statement, "Pricing architecture of the future gives us the opportunity to use modifiers and price that creates opportunities for value for our customers, as well as value for ourselves."

In recent years, shippers held the power in negotiation with carriers. Soon, though, these "modifiers" will lean heavily towards increasing carrier revenue instead of offering customer savings.

Changes on the Horizon

According to an industry freight index, “The heavy discounting that played a major role in parcel pricing for well over a year is finally starting to ease and UPS is taking a particularly aggressive approach, overhauling rating logic and rolling out new surcharges.”

This aggressive stance from UPS, coupled with FedEx's similar pivot, indicates a clear strategy to regain pricing power from shippers. Both carriers are increasingly focusing on higher-yield B2B shipments while reducing their involvement in the B2C sector, partly due to the rise of competition from startups, retailers, and even the US Postal Service.

For businesses, particularly those with lower shipping volumes, this may result in significantly higher costs per package.

What’s Going on With Fuel Surcharges?

We’re no stranger to fuel surcharges. But, in the past, fuel surcharges were linked to actual fuel pricing. Now, as the industry index notes, “Incessant changes by carriers to fuel surcharge logic continue to decouple it from the actual cost of fuel and solidify the surcharge as a revenue extraction tool, rather than its original intent as a cost-recovery mechanism.”

These rising fees are not just a reflection of fuel costs, but rather a deliberate action by carriers to bolster their bottom line.

Why Now?

The index explains, “Pressure to meet Wall Street expectations in the face of headwinds like high labor costs and low demand is driving increasingly aggressive efforts by UPS and FedEx to wrestle back control of pricing from shippers.”

Historically, carriers’ reluctance to negotiate with customers correlated with the strength of the shipping industry. That’s not what’s happening now. Instead, shippers are opting to divert their lightweight parcels to cheaper services offered by UPS and FedEx competitors.

Instead of attracting low-value, high-volume customers through discounts, the carriers are focusing on higher-yield parcels.

In this environment, where volumes are low and costs are high, discontinuing discounts and leveraging surcharges become crucial strategies for maintaining profitability and meeting investor expectations.

How Can You Save?

While the current outlook seems daunting for shippers, there's always room for savings, even when carriers are cutting back on discounts.

Sweeping discounts may be off the table, but every parcel contract has room for negotiation, and parcel audits can help you recoup money lost to billing errors and invalid surcharges.

Carriers are changing their discounting strategy, but they’re not ending altogether. Schedule a free Savings Analysis with ShipRx and trust the team with a 100% success rate in securing savings for shippers.