UPS 2020 Rate Increase: Key Trends And Takeaways

When breaking down the increase by service level and zone in the chart above, two areas stand out in specific. First off, 2nd and 3rd day shipments will see overall rate increases above the 4.9% average.

Secondly, the increases across all service levels will disproportionately affect shipments to longer zones. The average increase by zone for falls significantly below the average for zones 1-4 and and well above for zones 5-8. Overall, as ground networks get better at serving short zones within 1 to 2 days I would expect general rate increases to be heavily weighted towards outer zones in the coming years. This will have a much larger impact on companies dependent on time definite shipments, and companies with only one fulfillment center frequently sending shipments to outer zones.

Delivery Area Surcharges.

UPS seems to be moving in lockstep with FedEx in regards to delivery area surcharges. Both companies are now differentiated between Delivery Area Surcharge (DAS) and Extended Area Surcharges (EAS) which are much more remote and have a significantly higher surcharge attached.In addition to differentiating DAS and EAS, UPS has updated it's list of zip codes that each are applied too. The list will now be almost identical to that of FedEx, and the charges applied to each zone are completely identical.

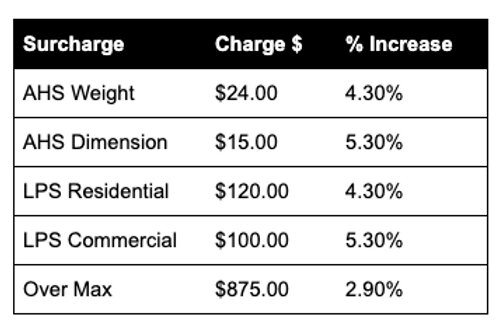

Additional Handling

UPS also seems to be following FedEx’s lead as well as past years trends by tacking on more charges to large packages. The primary change in this area is that the threshold for the Additional Handling Surcharge has been reduced from 70 to 50 lbs., once again following FedEx in perfect lockstep.In addition to decreasing the threshold for AHS; the charges assessed for additional handling surcharges, large package surcharges, and over max charges will all see slight increases. These charges will now perfectly mirror FedEx’s in 2020.

New Accessorial Charges

On top of standard increases, UPS will also be adding 3 new accessorial charges:- A $17 Rebill Fee for any package in which the billing account is changed

- A $150 Prohibited Item Fee for any shipment containing items that are prohibited by UPS policy or applicable law

- A $10 processing fee for any package filed for single entry that would qualify for consolidated customs clearance.

Key Trends and Takeaways

There are a few key takeaways from this years rate increase that might influence your shipping strategy in the coming year.One of the primary takeaways from this years rate increase is that, if it wasn't already clear, neither UPS or FedEx want your large packages to be shipped through their parcel network. The surcharges for additional handling, large package, and over max have been increasing steadily for the past two years, and the reduction of the AHS threshold from 70 lbs. to 50 lbs. is a significant jump.

We should take note of the fact that these increases are put in place in the form of a flat rate surcharge, not a rate increase. If either FedEx or UPS was just trying to remain profitable while shipping large packages, they would implement increases that were dependent on exact weight and zone. But the fact that they are flat rate surcharges is a clear effort to dissuade shippers from sending large packages. If you routinely ship packages 50 lbs. and above, it might be time to begin exploring other options than FedEx and UPS.

This move away from large packages falls in line with FedEx's recent announcement of plans to expand their residential freight network, FedEx Freight Direct. While we haven't seen a matching announcement from UPS, it's not far fetched that it might be coming. Both companies are trying to streamline their parcel operations and large packages simply don't make it through their sorting facilities and equipment as easily as smaller, traditional parcel packages do. Thus, we may very well see both FedEx and UPS expand their residential delivery options for large packages via other networks in the coming years. However, in the meantime, as previously stated it may be a good time to explore alternative carriers for you large packages.

Another key trend to take note of is that rate increases continue to be weighted towards long zones. If this trend continues, it will create a strong incentive for companies to develop a shipping strategy with multiple fulfillment and distribution centers. With E-commerce and Direct To Consumer shipping on the rise, companies that can get warehouse space closer to their customers will likely be rewarded.

Overall, this rate increase announcement seems to be well in line with the increase FedEx announces earlier this year. General rates between the two companies are converging, and surcharges for extended delivery area and large packages are moving in near complete lockstep. For an evaluation of what this rate increase means to your company specifically, contact a 3rd party expert like SHIPRX for a free analysis.